The most well-known indicator of inflation is the Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods and services consumed by households.

In Australia, the CPI is calculated by the Australian Bureau of Statistics (ABS) and published once a quarter. To calculate the CPI, the ABS collects prices for thousands of items, which are grouped into 87 categories (or expenditure classes) and 11 groups. Every quarter, the ABS calculates the price changes of each item from the previous quarter and aggregates them to work out the inflation rate for the entire CPI basket.

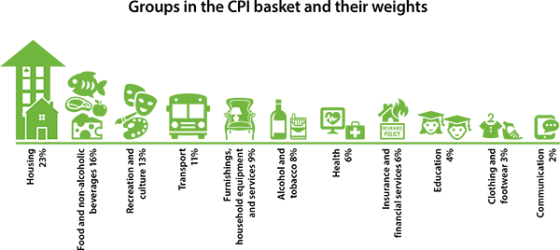

Pictured: Selected groups in the CPI basket and their weight when compared against each other. In deciding which goods and services to include in the CPI basket and what their weights should be, the ABS uses information about how much – and on what – households in Australia spend their income. If households spend more of their income on one item, that item will have a larger weight in the CPI. For example, the ABS included smart phones in the CPI to reflect consumers taking advantage of advances in technology. Data on household spending across all items is only available approximately every five years or so.

CPI Graph

You’ll note a gradual increase of the cost of goods and services over time. It’s expected that wages and salaries will increase proportionally.