A Guarantor Home Loan, or ‘Family Pledge’ Home Loan, allows family members or, in some cases, someone else who is close to you, to ‘guarantee’ your home loan. This means they will be responsible for servicing the loan if you can’t. A guarantor will usually has to offer equity (such as a percentage of their own home) as security for part or all of your mortgage.

A Guarantor Home Loan is the only way to borrow between 100% and 110% of a property’s purchase price. Essentially, 80% of your loan amount will be secured on the property you’re purchasing, and the remaining 20% will be secured by your Guarantor’s property.

A guarantor is the only way to borrow the full property amount, stamp duty and taxes, and perhaps even consolidate debt. The amount borrowed may also include other costs such as moving fees.

How Much Can I Borrow?

The amount you can borrow with a Guarantor Loan depends upon the type of loan for which you’re applying.

- First home buyers: 105% of the property value.

- Construction: You may generally borrow up to 105% of the total land value and cost of construction.

- Refinancing: 100% of the property value.

- Debt consolidation and purchase: 110% of the property value.

- Investors: 105% of the value of your investment property.

Many banks will have additional credit criteria for loans above $1,000,000.

How is the Guarantee Loan Structured?

As mentioned, the loan is secured by the purchased property, and that offered as security by your guarantor.

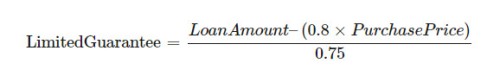

We generally recommend a ‘Limited Guarantee’ which limits part of the loan by the guarantor’s property – this limits the guarantor’s exposure. This essentially means that the guarantor is only liable for a portion of the lender’s borrowing – not the full amount. You may determine the limited guarantee with the following formulae:

Use the calculator below to determine the limited guarantee obligation. It’s a basic calculation only; it doesn’t include such factors as debt consolidation, security property type, your 5% genuine savings  , and whether it’s a construction loan. We’ll help you with the finer details.

, and whether it’s a construction loan. We’ll help you with the finer details.

As a guarantor you should review our ‘Guarantor FAQs‘ to assist you with your decision.

Types of Guarantees

There are four primary types of loan guarantees.

Security Guarantee

This type of guarantee is most often used when first home buyers with an excellent credit history buy a home yet have no deposit. Some lenders will also call the guarantor an “equity guarantor”.

Security and Income Guarantee

A security and income guarantor is often used by parents to help a child that has a low income to buy their first property. The lender will use the parents’ property as additional security and use the parents’ income to prove the loan is affordable.

Limited Guarantee

As discussed above, and further introduced by way of the simple calculator, the limited guarantee is when only part of the loan is guaranteed by the guarantor. This is most often used with security guarantors to reduce the potential liability secured on the guarantor’s property. Guarantees can either be limited or unlimited, depending on both the guarantor and lender requirements.

Family Guarantee / Parent Guarantee

Often referred to as a ‘Family Pledge’ Guarantee or “Parental Guarantee”, this is when the guarantor is directly related to the borrowers – normally a parent. Grandparents, siblings and other family members as guarantors are considered on a case-by-case basis.

Commonly Asked Questions

Can I Use a Guarantor for a Second Home?

Yes, Guarantors are not just for First Home Buyers. However, a bank requires that you be in a strong financial position. Generally speaking, there’s usually a few lenders that might pair with your particular circumstances, and we’ll make that introduction.

Do I Require Genuine Savings?

Most lenders will still require you to demonstrate Genuine Savings of around 5%, although there are a few exceptions. Lenders need to back their lending with a sound risk assessment, so they need to know that you’re able to service the loan. In most cases a high income and low asset position is considered high risk, while younger couples that have demonstrated savings for their first home generally present as lower risk. In some cases, rent may be used as genuine savings (since the rent would otherwise translate to savings if it didn’t have to be paid), although this doesn’t apply with all lenders.

Can I Buy an Investment Property with a Guarantor

There are lenders in Australia that will lend for investment property, but they’re the exception rather than the rule. Approving multiple investment properties is generally not permitted since it assigns too much risk to the guarantor.

Is it Acceptable That My Guarantor Has a Home Loan?

While it is acceptable that your guarantor have loan on the property they’re using as security, there are requirements that apply. Generally speaking, and as mentioned above and demonstrated by way of the Limited Guarantee calculator, your guarantor needs to meet the prescribed Limited or other Guarantee option, but also have sufficient equity in their own home. The addition of their limited equity security and their existing debt should not exceed 80% of the value of their property.

What Happens if I Cannot Meet Payment Obligations

If you cannot meet your mortgage obligations your first point of contact should be us, particularly if it’s a result of hardship, such as those experienced during the Coronavirus Pandemic.

A bank will always seek to take action on your property before claiming against your guarantor. A repossession normally won’t be initiated less than 3 to 6 months.

Removing the Guarantee

You may apply to have your guarantor removed when the following conditions are met:

- You can afford the repayments without any assistance, and you can provide evidence to support your claim (conditions would normally be consistent with an early application).

- Your loan is for less than 90% of the property value (ideally 80% or less).

- You haven’t missed any payments in the last (usually) 6 months.

Once the guarantor is removed you may consider alternate finance options to minimise your obligations.

Is Insurance a Consideration?

To provide protection to you, your family, and your guarantor – as is the case with most mortgage obligations – it often makes sense to consider appropriate life, total and permanent disability, and/or income protection insurance. We can help you with sourcing suitable options if required. It is not a requirement for the loan.

My Guarantor Wants to Sell Their Home

If you’re unable to release your guarantor from a loan based on the criteria above, they may be unable to sell their home – a limitation they should consider when providing the Guarantee.

It’s not uncommon for a guarantor to provide the lender a dollar-for-dollar term deposit. If the lender permits it the term deposit will remain untouched until the guarantor can be released from their obligation.

My Guarantor Isn’t Acceptable

In many cases you won’t have a Guarantor available to you, or your available options don’t qualify. However, there are options. Some of these options include the following:

- Considering a No-Deposit Home Loan, or tiered non big-bank lender that increase their risk with an increased rate.

- Using a gift deposit.

- Buying a property as part of a cooperative, as a co-borrower or co-ownership investment loan.

We’ll work with you to explore the available options that fit your income, lifestyle, and circumstances.

Related Articles in our Blog

You may find useful information and articles in our blog. Feel free to call anytime on 0458341021 for any reason.